salt tax cap removal

Tom Suozzi writes For 100 years Americans relied on. The governors on Friday argued For the first time since Abraham Lincoln created the federal income tax the cap on SALT deductions established a system of double taxation.

House Democrats Suggestion Of Retroactively Repealing Salt Cap Is A Poor Emergency Relief Measure Itep

Septic Tank Removal Middlesex County Costs Knowing the septic tank removal Piscataway costs is recommended before starting a septic tank removal project.

. Ace Removal 732 521-5500. Doubling the cap to 20000 would remove the marriage penalty but it would reduce federal revenue by about 75 billion between 2022 and 2025. The House on Thursday voted to temporarily repeal much of the GOP tax laws cap on the state and local tax SALT deduction a key priority for many Democrats.

As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a. A fifth of those or. 2 2022 1042 am ET.

In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep. 52 rows The deduction has a cap of 5000 if your filing status is married filing separately. YEARS IN BUSINESS 718 816-7200.

Removal and control services in NJ. While looking at national. A host of moderate Democrats say they wont support President Joe Bidens 35 trillion package without a repeal of the cap on state and local tax deductions known as SALT.

Responding to reports from yesterday that the State and Local Tax SALT deduction cap lift may be removed from President Joe Bidens Build Back Better plan Gov. The states 2018 analysis showed 752000 Californians earning less than 250000 a year paid an additional 1 billion in federal taxes thanks to the SALT cap. This cap remains unchanged for your 2021 taxes and it will remain the same in.

Tell us about your project A ALERT. Throughout all those years billions of dollars each year have been lost via contamination of. The deal which was included.

Democrats have forged a compromise to partially lift the so-called SALT tax deduction cap that hit the New York metro area particularly hard. These rodents have been pests for millions of years. Use our free bidding system to get a quote from Ace Removal 2 more of the best.

Staten Island NY 10301.

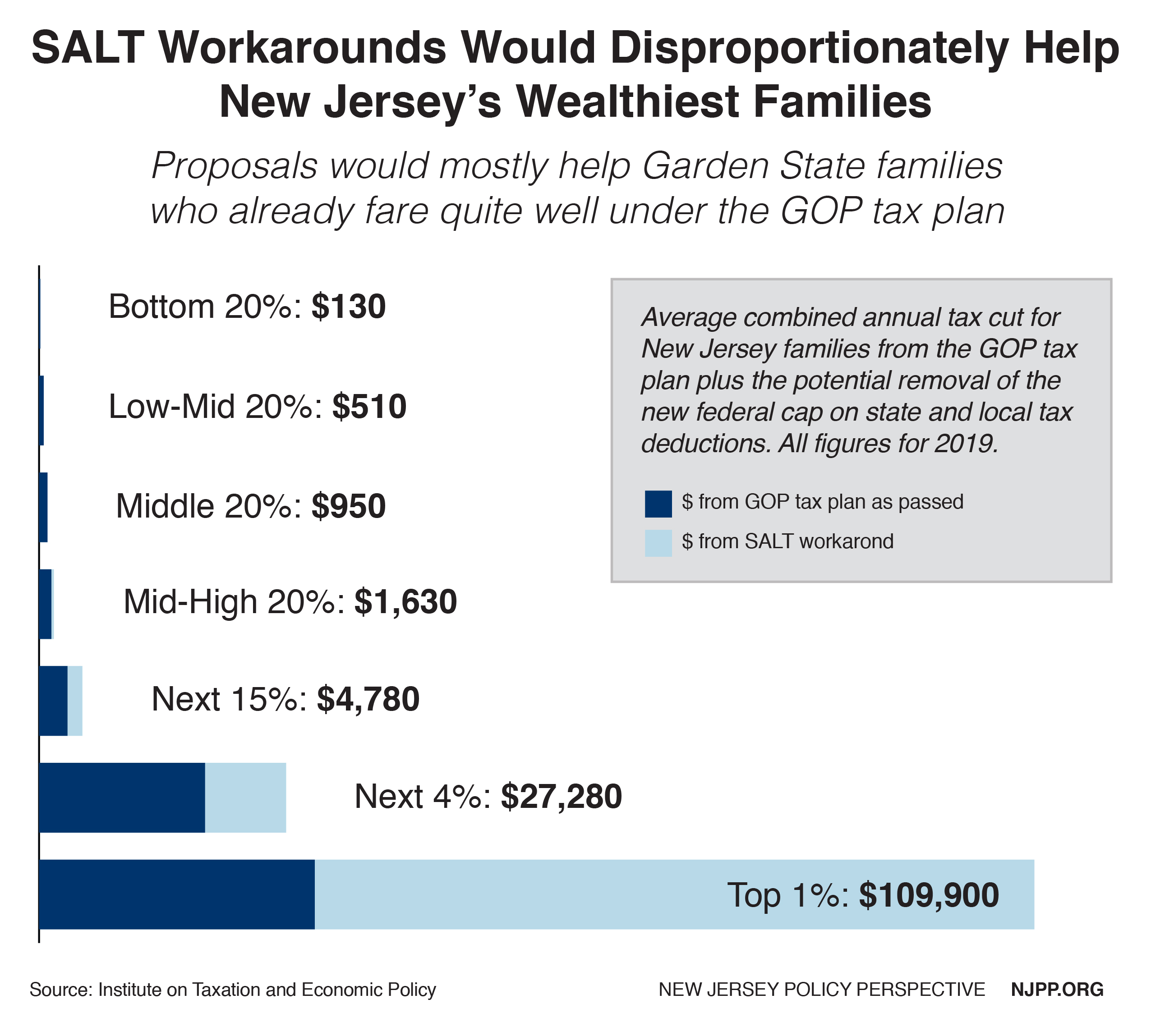

A Grain Of Salt New Jersey Needs More Than Workarounds To Respond To Gop Tax Plan New Jersey Policy Perspective

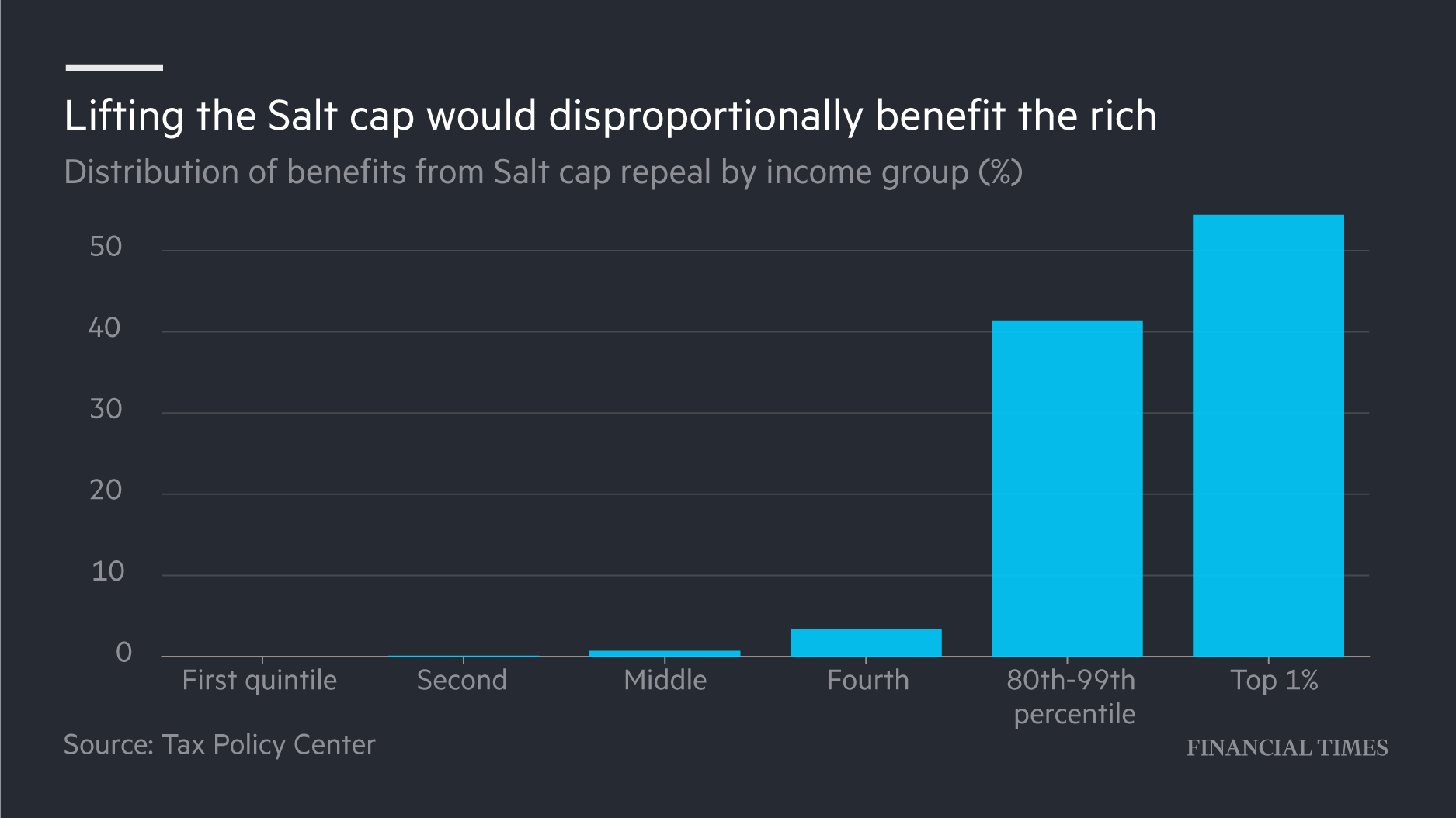

Eliminating The Salt Deduction Cap Would Reduce Federal Revenue And Make The Tax Code Less Progressive

/StateandLocalTaxCapWorkaround-1bbc2598e0144769b6e2542e11d22839.jpg)

State And Local Tax Cap Workaround Gets Green Light From Irs

Nancy Pelosi Privately Opposes Repeal Of Salt Deduction Cap

Nj House Delegation Calls For Elimination Of Salt Tax Hike

Lawmakers Launch Bipartisan Salt Caucus Escalating Push To Remove Cap On Federal Deductions For U S State And Local Taxes Marketwatch

Reconciliation Talks Complicated By Salt Tax Hurdle Roll Call

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Strategies To Preserve Salt Deductions For High Income Taxpayers

By Backing A Huge Tax Giveaway To The Rich Democrats Are Giving The Gop A Perfect Midterm Gift

High Income Households Would Benefit Most From Repeal Of The Salt Deduction Cap Tax Policy Center

Financial Times On Twitter Raising Top Income Tax Rates Is Not Sufficient To Raise Revenue The Rich Often Make Money Through Capital Gains Which Are Taxed At A Lower Rate Biden Is

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

No Salt No Deal N J Reps Want Trump Era Tax Cap Removed Whyy

Dems Don T Repeal The Salt Cap Do This Instead Itep

New York Business Leaders Push Biden Schumer To Remove Cap On Salt Deductions

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities